Risk reward ratio formula provide traders with the most important calculation to measure the potential profit an investment can provide for every rupee of risk that a trader takes. A trader or investor can never predict the direction of the market with 100% accuracy and hence every trade has a certain risk

We all know that the stock market is one of the riskiest places to generate returns on capital. So, while the direction of the market is not in our hands, managing the risk in the trade is something which a trader can control. It is one of the metrics for calculating and managing risk in the trade. Once Risk to Reward ratio with entry and exit levels are fixed by the trader, he needs to follow rules and respect the levels at which risk reward ratio was calculated.

Risk Reward Ratio formula

Suppose the current price of a stock is 100 Rs . Based on your analysis, you see that stock prices can either go up from here and will face resistance at 130 Rs (Let’s say this is your Target or take profit value ) . The stock prices can come down till 80 Rs where you will take your stop loss . Now lets calculate the risk and reward in this trade

Risk (If trade goes against your direction) : 100-80 = 20 Rs

Reward (If trade goes in your direction) : 130-100 = 30

Risk reward ratio formula : 30/20 = 1.5 ( Most of the places you will find calculation as 20/30 but I do it this way which is easier to understand and take trading decisions . You can also call it reward to risk ratio formula)

In simple terms 1.5 here means that for every 1 Rs of risk , there is a reward of 1.5 Rs.

Example:

In Fig 1:

Stop loss : 77 Rs , Entry price : 81.75 , Profit level: 94.15

Risk : 81.75-77 = 4.75

Reward : 94.15-81.75 = 12.4

Risk reward ratio = 12.4/4.75 = 2.61

Why calculating Risk Reward in every trade is Important

There is no trading setup with 100% winning probability and hence every trade involves a certain amount of risk . While this ratio is used by every kind of trader ( Swing / positional / intraday ) , it’s very important for intraday traders as they have to make decisions in minutes to enter and exit the trade. The risk/reward ratio is also very important for long term profitability. Ideally it’s better if a trader takes trades with a risk reward ratio greater than 1 . You know why ? Wait ! I will explain this with calculation after you understand “Winning rate”.

Winning rate of your Trading Strategy:

You should know the winning rate of your trading strategy which can be 40%, 50% or more. Suppose if winning rate is 40% , it means that out of 100 trades taken 40 was profitable and 60 in loss . Now lets assume that risk reward ratio of your strategy is 2 . This means that when trade is in loss it will be 1Rs and when trade is profitable it will be 2 Rs . So basis 40% winning rate what will be profit and loss after 100 trades?

40 (Trades which are profitable) * 2 Rs (Profit when trade is in your direction) = 80 Rs Profit

60 (Trades which are in loss) * 1 Rs (Loss when trade is not in your direction) = 60 Rs Loss

Profit and Loss ( In 100 trades) : 80-60 = 20 Rs

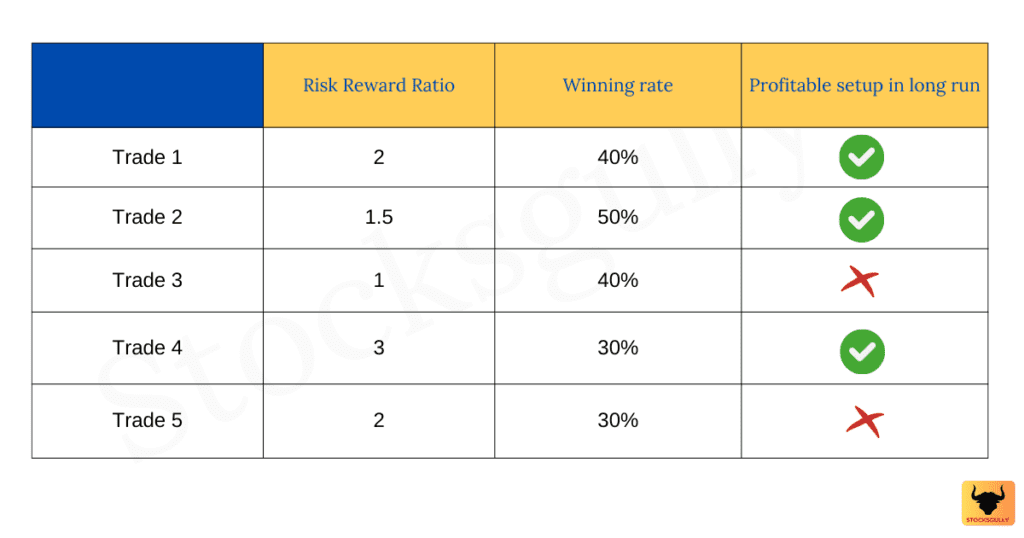

So with 40% winning rate and 2 as your risk reward ratio , you are profitable in 100 Trades. Now lets see the table with different combination of winning rate and risk reward ratio.

What you should do after calculating Risk Reward Ratio?

- If the Risk Reward ratio is favourable as per your trading strategy , you can take the trade .

- Put stop loss in the system. If you don’t do this then there are two risk

a) If the trade goes against you and stop loss is not in the system , then the emotion of HOPE might come . It will stop you from taking stop loss even if the running loss is more than the risk you have calculated before .

b)If a big candle is formed against your direction and stop loss is not in the system, running loss in the trade will suddenly become very big . Now you will exit the trade with a big loss.

We have already seen that there is a connection between the risk reward ratio and winning rate of a trading system. The higher the risk reward ratio, the lower the required winning rate to become profitable. If you have back tested your strategy then wait for profit levels as per risk reward ratio. It also highlights the fact that a trader does not have to win all (Even if winning rate is less than 50%) of their trades in order to make money in long-term.

Risk reward Ratio : Points to consider

It might not be accurate

If a trader does not mark the take profit and stop loss levels correctly , then Risk Reward calculation might become confusing for the trader.

Stock Gully tip : Once you know the concept of risk reward , it’s very natural to forcefully calculate a favorable risk reward ratio even if it’s not there on the chart . You try to forcefully mark stop loss and take profit levels with a good risk reward ratio . It happens because in your mind, the trade is looking good but it might not be a good risk reward trade as per charts . So first analyze the chart without thinking about this ratio and once you have mark levels then calculate it .

It doesn’t tell you direction of the trade

Risk reward calculation is a risk assessment tool and it doesn’t tell you in which direction the prices will move. So use this calculation for deciding whether you should take the trade or not if risk reward is in your favor.

It is not same for all strategies

Risk reward ratio changes as per strategy . Some trading strategies will have a risk reward ratio which is 1 or 2 and some will have higher ones like 4 or 5 etc. It depends on the traders setup . A profitable risk reward ratio depends on the winning percentage of the strategy which you apply.

It changes as per your trading style

Investors/Traders with a higher risk tolerance may be comfortable with high-risk and high-reward trades . They might trade on strategies with low winning rate but high risk reward ratio. A more risk-averse traders may seek investments with lower risk and lower potential returns and hence trading strategies will also change.

Frequently asked questions

What is a good Risk Reward Ratio?

It depends on your setup and its winning ratio . If your setup has a winning ratio more than 50% , then risk reward greater than 1 is good for long term profitability .

It also depends on the stock or index you are trading too .

Example:

If you decide to take a risk of around 10 Rs in “stock A” and reward of around 20 Rs ( Risk reward ratio of 2:1 ) , then do some backtesting to see whether stock A moves 20 Rs in a single day or not ( In case of intraday trade ) . It should not happen that you take a risk of 10 Rs but stock when moving in your direction it moves only 10-12 Rs ( As per your backtesting ) . In this case you should lower down your risk in every trade to maintain 2:1 risk reward.(But it should be logical stop loss otherwise dont take that trade)

Risk risk/reward ratio calculator?

It can be calculated using formula : ( Take profit level – current price ) / ( Stop loss levels – Current price )

Key takeaways and points to remember

- The risk-reward ratio is a measure used in investment and trading to assess the potential return on the amount of risk taken.

- It compares an investment or trade’s expected or potential profit (reward) to its possible loss (risk).

- A higher risk-reward ratio indicates a greater potential reward relative to the risk, while a lower ratio suggests a lower likely premium than the risk.

- The risk-reward ratio is essential for investors and traders to evaluate and compare different investment opportunities or trading strategies.

- Risk reward ratio is connected with winning rate of your strategy.