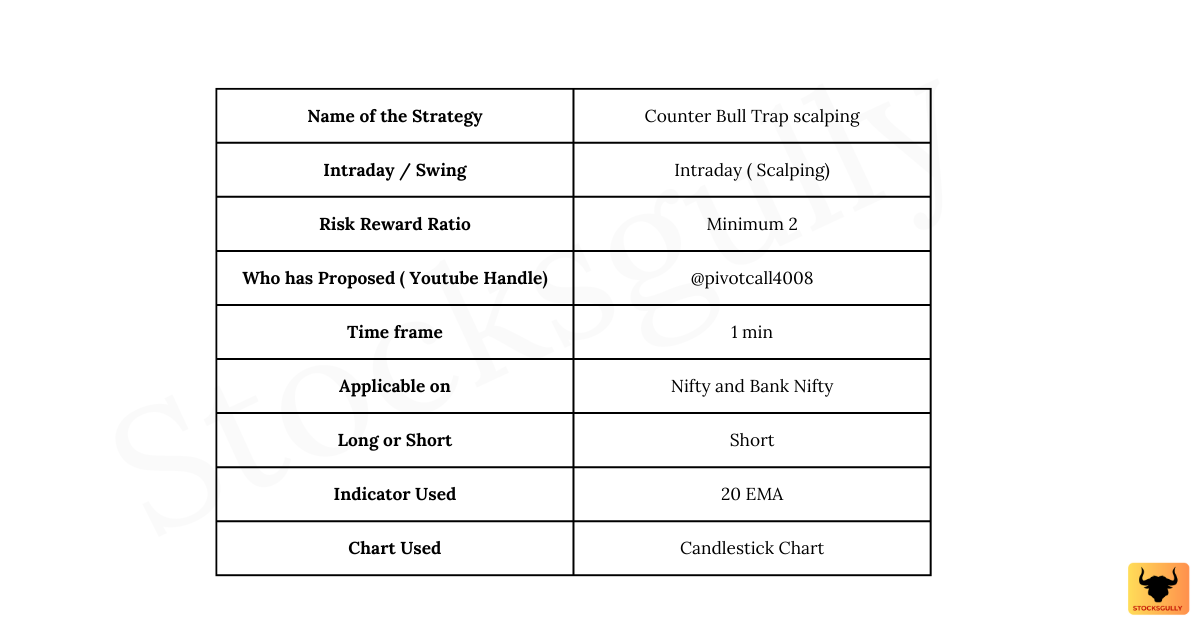

In this “Intraday Trading Strategies : No 9”, we will discuss “Counter Bull Trap Scalping Strategy”. This we can apply when we can expect prices to go down.

Concept

- Moving average is a lagging indicator which means it follows price movement and gives confirmation of an ongoing trend to a trader.

- When candle closes above 20 EMA in a downtrend, then there are chances of reversal on the upside. There will be lot of traders who will take early entry assuming that trend has reversed. If we see Bearish candlestick pattern after 20 EMA is broken upside, we will enter the trade in the direction of downtrend. All traders who previously entered early assuming that trend has reversed , are now trapped and they will exit giving us profit.

Counter Bull Trap Scalping Strategy

Indicator used: 20 EMA

Entry Rule

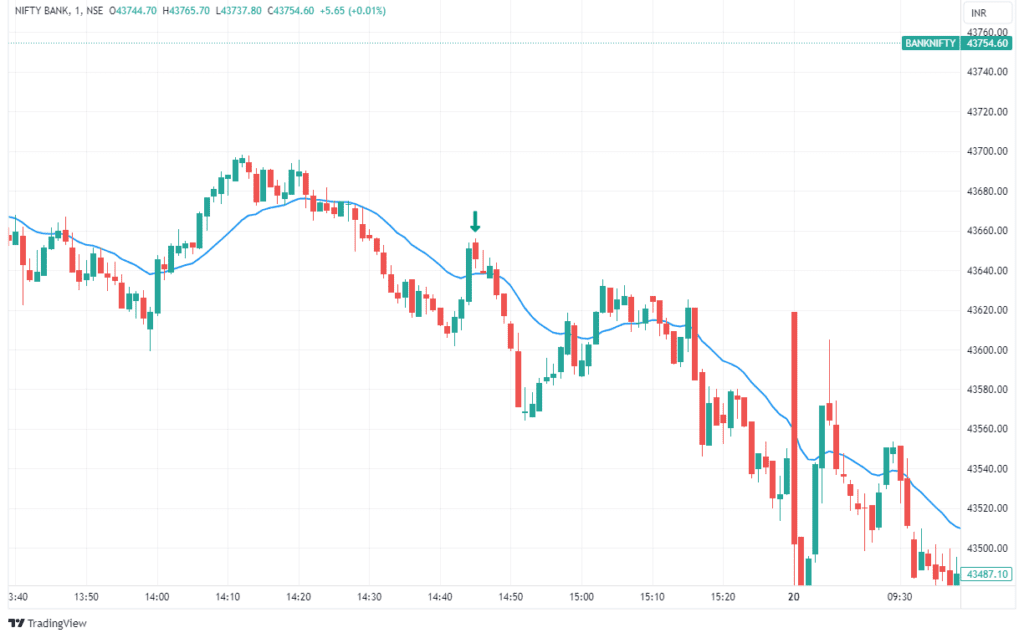

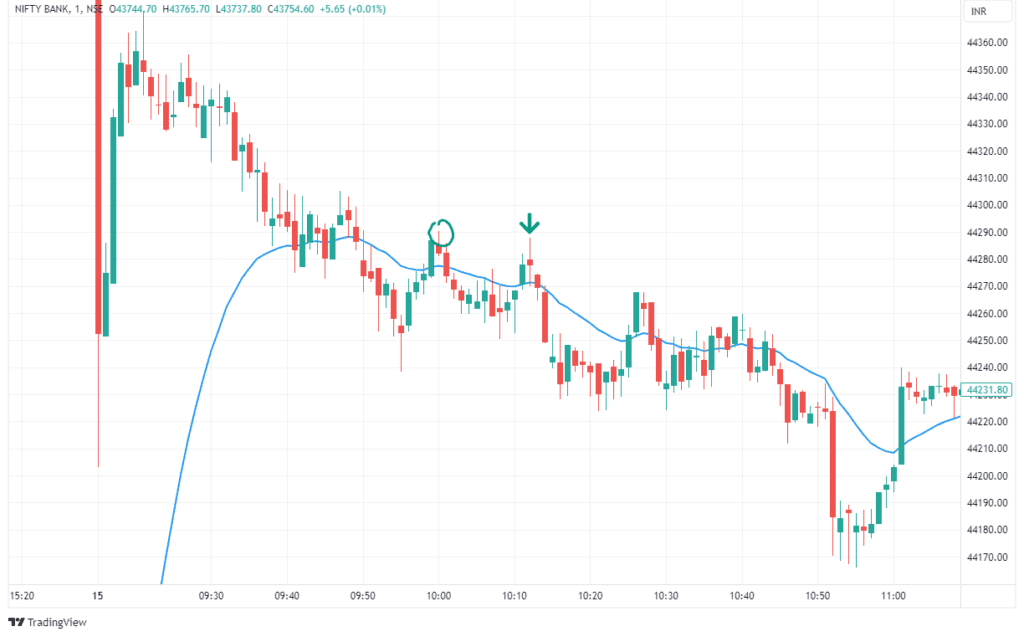

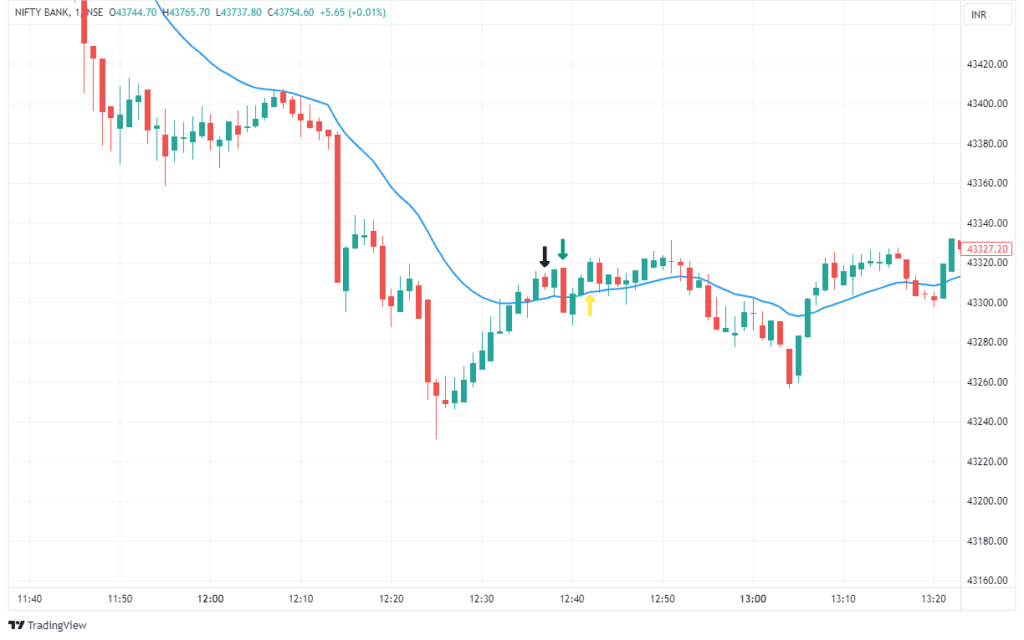

Step 1: Identify downtrend in a 1 min timeframe. Now the question is how will you identify the same? So look for 2 things

- Prices should be below 20 EMA

- 20 EMA should be sloping downwards.

Step 2: Wait for a green candle to close above 20 EMA during retracement. This will be our “alert candle”

Step 3: If the red candle (It should be strong red candle and not a small body candle) is formed after green candle (Alert candle) and closed between the body of green alert candle then we will enter the trade. ( This red candle is now our entry candle )

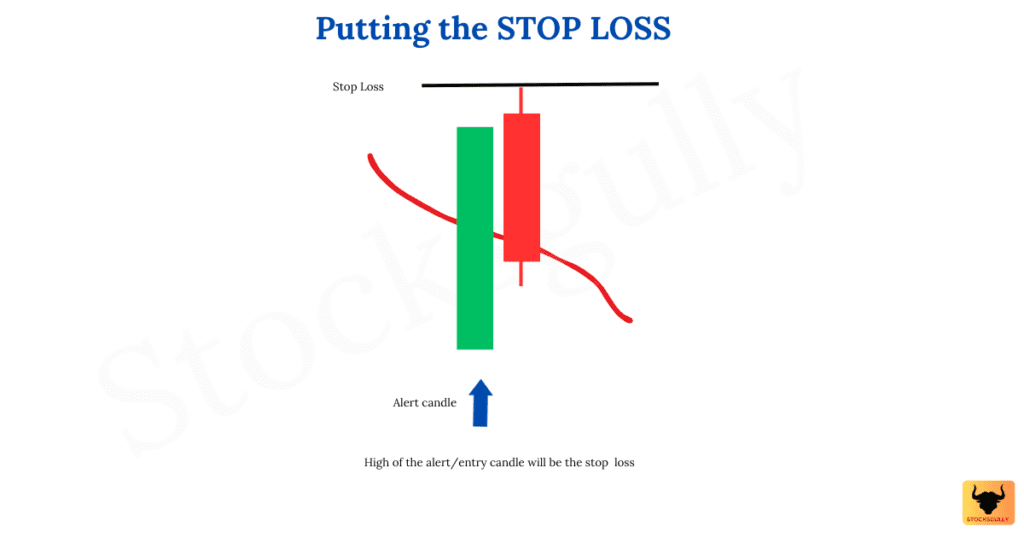

Stop Loss

Stop loss will be high of Alert or Entry candle (Whichever candle high is higher )

Exit Rule

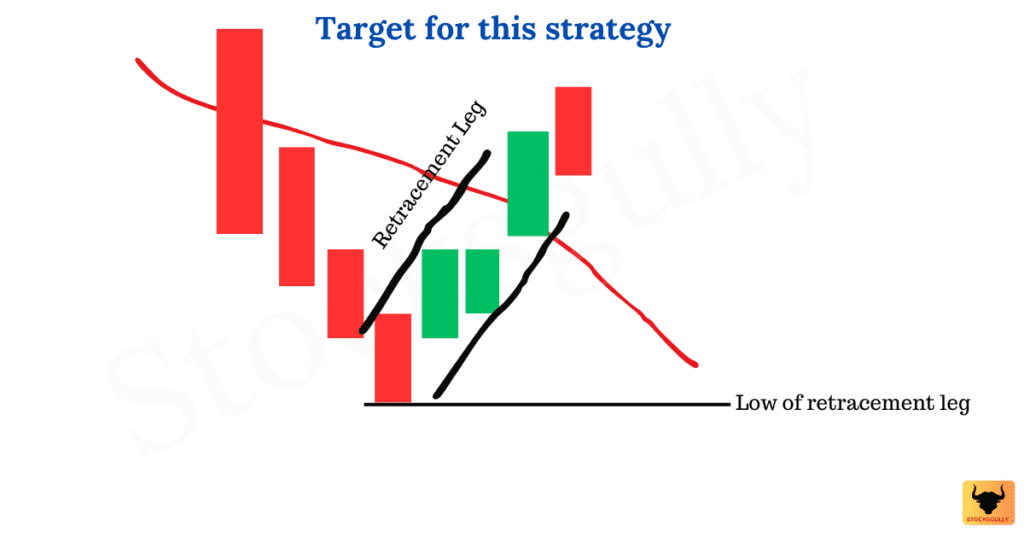

For this strategy we will keep risk reward of 2 and hence our target will be at least double of our risk in the trade. There are two ways you can exit:

- Exit once you get the risk reward of 2 (You can also trail the stop loss after getting risk reward of 1)

- Exit once the prices touch low of retracement leg.

Important points to consider basis this setup

- This is scalping strategy in 1 min timeframe so entry and exit must be very fast.

- It will be a high probability setup if the stop loss level is also some resistance level (Like CPR or a previous supply zone or Previous day high (PDH) or previous swing high etc.)

- Scalping should be done once you have good experience in trading as the prices move very fast in 1 min timeframe.

- Scalping involves multiple entry and exit and hence trader might experience mental exhaustion.

Backtesting

Always backtest the strategy before taking actual trades in market. The strategy should suit your trading style and psychology.

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary for educational purpose only and does not constitute investment advice. StocksGully will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.