In this “Intraday Trading Strategies : No 12”, we will discuss “50% First Swing Scalping Strategy” for BankNifty .This we can apply when we expect prices to go down or up basis price action.

Concept

As this is a scalping strategy , we will be trading on 1min timeframe basis this setup . The entry and exit will be very fast and hence trader needs complete focus and attention till the trade completes.

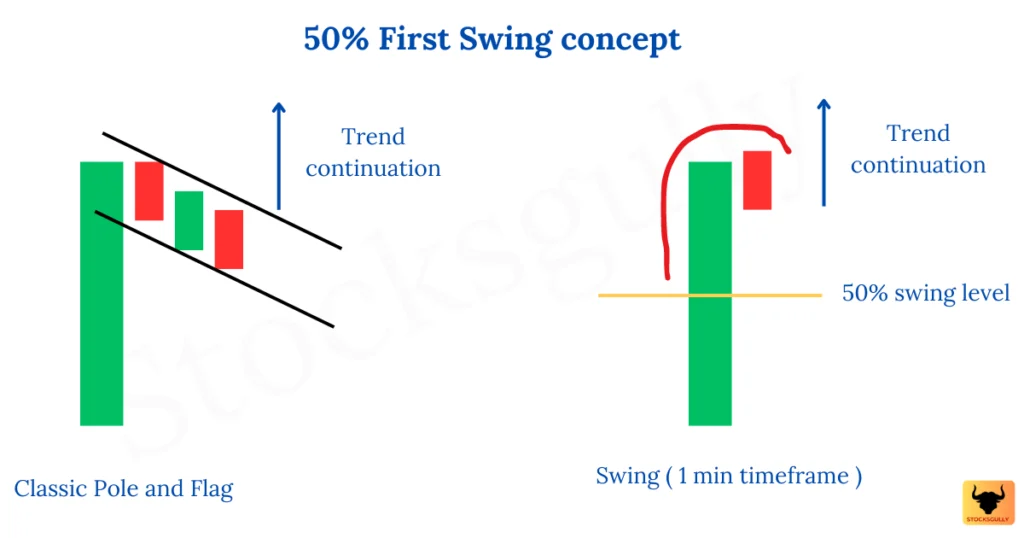

- This setup works on flag and pole pattern but on a very short timeframe ( 1 Min ) . This means a pole can be just one candle retracement.

- From 9:15 am ( When market opens ) till around 9:45 – 10 am , market volatility is high and sometimes direction of market is not decided. We will take entry in first 10/15 mins to make profit in high volatility and when there is high momentum. Once market settles then market direction can be gauged by traders ( Basis technical patterns or higher timeframe support and resistance etc. )

- First candlestick type and its location gives an indication about market movement for initial few minutes.

- If prices doesnt break 50% of swing low/high , then it is assumed trend will continue in the direction of current trend.

50% First Swing Scalping Strategy

Entry Rule

Step 1: First mark important support and resistance at 15min / 30 mins timeframe . As we will trade on 1 min timeframe so marking important levels at 15 min and 30 min is fine and there is no need to go to higher timeframes. ( While a trader can mark at higher timeframes also but marking at 15 min and 30 min is must )

Step 2: First candle should form near support and resistance marked in the first step. This means a trader will get some indication whether the marked levels is respected or getting breached.

Step 3: The wick in first candle ( In candlestick direction ) should not be more than 5-10% of range of first candle. This point is very important and lets understand it basis color of the candle .( Range of candle = High – low )

a) Green candle : If there is wick at high of the candle , then wick length should NOT BE more than 5-10% of the range of the candle

b) Red candle : If there is wick at low of the candle , then wick should NOT BE more than 5-10% of the range of the candle.

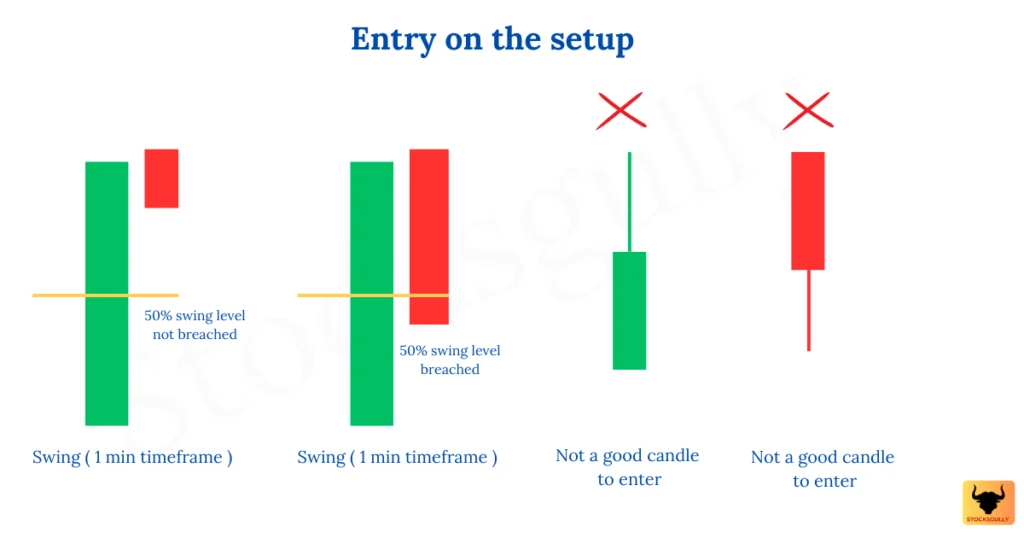

Step 4: We will wait for first swing to form and mark 50% level of that swing.

Step 5: Enter immediately if 50% level is not breached. ( If retracement candle break 50% of the level then this setup is not valid )

Stop loss

An ideal stop loss for this setup will be 50% of swing level but we will exit if loss is around 40-50 points on spot chart ( This means around 20-25 points in ATM ) . As this is scalping setup so prices can move really fast if movement is against the trade . A trader should follow the stop loss very strictly in scalping

Exit rule

We will maintain minimum risk reward of 2 in this setup . This means if we are taking a risk of 40-50 points , then exit will be around 80-100 points on spot chart .

( As BankNifty lot size is 15 , so 20-25 Rs risk means a risk of around 350 Rs and reward of around 700 Rs )

Lets see some examples

1. The swing is formed after 1st candle

2. The swing is formed after few candles

Important points to consider basis this setup

- This setup works in Bank Nifty as there is high volatility and movement once market opens ( In initial few mins )

- We will enter in first 15 mins and we will not enter into any trade after 10 am .

- Market should open at important levels which can also be a round no ( Like 45000 / 45100 etc. ) or a support / resistance level . If level is a multiple of 500 or some support/resistance zone at higher timeframes ( Like 1 day etc. ) and also at 15/30 min timeframe then its better . It means the support or resistance level is strong.

Backtesting

Always backtest the strategy before taking actual trades in market. The strategy should suit your trading style and psychology.

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary for educational purpose only and does not constitute investment advice. StocksGully will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.