Whether you’re a beginner or an experienced trader in the stock market, one concept that you should definitely know is “India Vix meaning” and why it is important to a trader.

It’s an index which can give you a signal or warning about market movement in the future and hence it’s very important to understand this term. We will not discuss the history of India Vix like “who has discovered” it OR “how it is discovered” but the practical aspect which will help you in trading markets.

Full form of India Vix : “India volatility Index” and it is expressed in percentage(%).

India Vix Meaning?

It is the volatility index that measures the market’s expectation of volatility over the near term. In other words, it explains the volatility that the traders expect annually in the Nifty50 Index. For example, if the India VIX is currently at 11, this simply means that the traders expect 11% volatility annually.

For example, if the Nifty 50 is trading at 20,000 and India VIX is trading at 20, then expected volatility over the year will be:

- Index spot: 20,000

- India Vix: 20

- The expected downside for the year = 20,000 – 20% of 20,000 = 16000

- The expected upside for the year = 20,000+ 20% of 20000 = 24000

Here, the expected range for the year is between (16000 and 24000) for that index.

As mentioned in the example above , India vix only predicts the scale of movement in the market and not the direction of the prices. So in above example India Vix predicts that market which is currently at 20000 can move up to 24000 or down to 16000 but you can’t predict in which direction it will move.

How to find Monthly and Weekly Variation based on % of India Vix ?

When we say India Vix is 11 , then 11% is annualized variation expected and if you want to find monthly variation then just divide 11% by root of 12 which means around 3.2% . So in a month you can expect index to move around 3.2% up or down from current levels.

Note:We have divided by root 12 because there are 12 months in a year.

Similarly if you want to find weekly variation then divide value of india vix value by root of 52.

Why is India VIX so important?

All the major directional moves in the market are usually preceded by a range bound market. So after a trending market , a trader can see sideways market and then either market continues in the same direction or trend reversal happens. India VIX plays a very major role in understanding the confidence or fear factor amongst traders.

- A lower VIX level usually implies that the market is confident , there is little or no fear in the market and hence lower volatility is expected with a stable range.

- A higher VIX level usually means high volatility and lower trader confidence about the current range of the market. This also indicates risk and fear in the market and a directional move can be expected in the market.

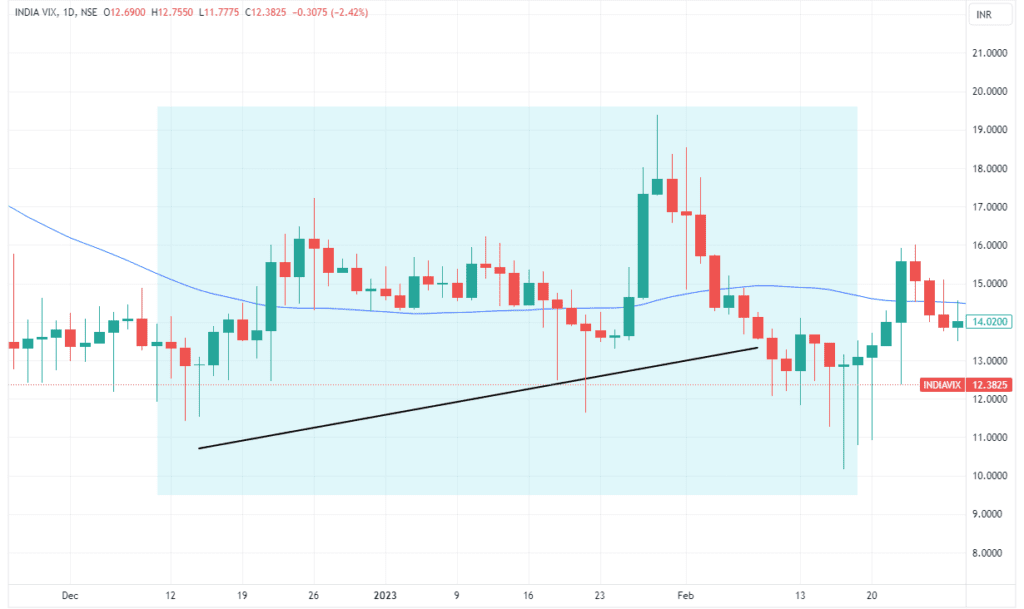

So , when the market moves rapidly up or down , India vix rises. Now , lets see India Vix chart and observe if it rises during periods where there is fear or risk in market .

Overall, India VIX plays a major role in understanding the sentiment of the market.

Is there an ideal range for India VIX?

As india vix changes basis market sentiment , so there is no defined ideal range but we can analyze it basis India Vix chart.

From the chart we can say that VIX ranges between 10-30 for most of the times. When it goes below 10 or above 30, it can be considered as a deviation. There are periods when india vix rises like Budget Day , COVID-19 period but that’s an outlier and event based movements.

I hope the concept and India Vix meaning is now clear to you . In the next article we will understand how India vix impacts Option buyer and Option seller. So as a trader if you know that before certain event like Budget day etc. India Vix will rise , can you change your strategies or stay away from market for some time ? A very low India Vix also means low option premiums and range bound markets . It might not suit traders who are looking for breakouts and high volatility to earn money from spike in premiums.

We will understand all these aspects in subsequent articles.