Morning Star pattern is a reversal candlestick pattern which can give a very good risk reward ratio if identified correctly. We will understand 3 things here like we cover in every Bullish Candlesticks patterns

- What is a Morning Star pattern?

- How to spot this pattern on a chart and what it means?

- How to take high probability trades using this pattern?

Type of candlestick pattern: Reversal candlestick pattern

No of candlestick pattern: 3 candles pattern

What Is a Morning Star Pattern?

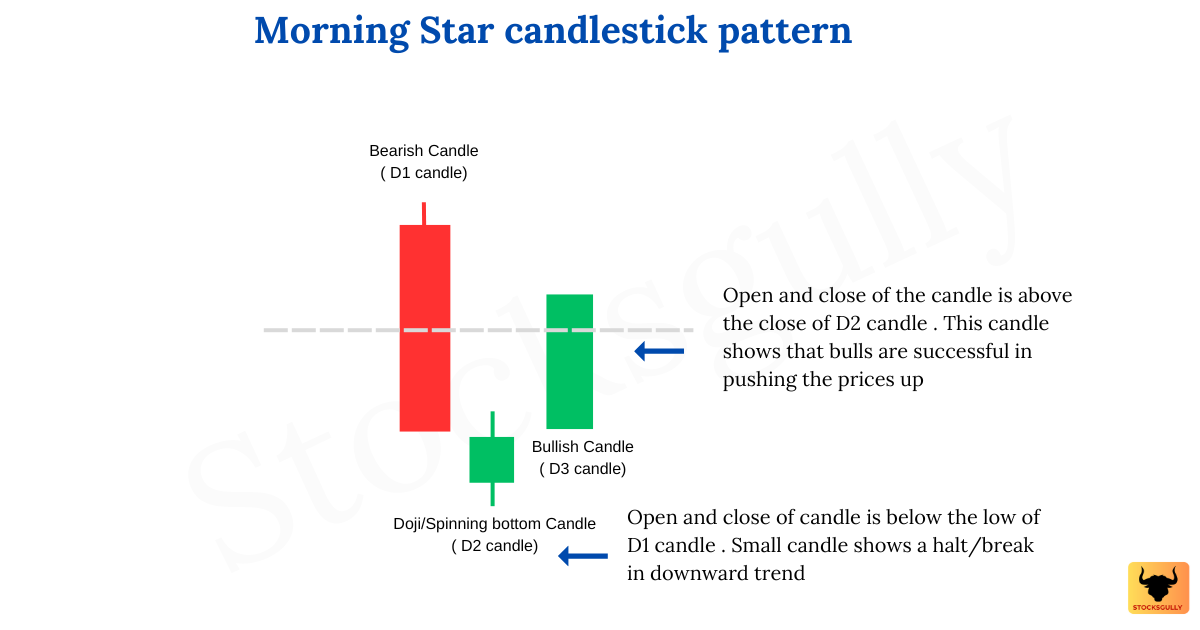

We will understand this pattern assuming we are trading in a daily timeframe. Suppose there is a downtrend going on and a day (Let us say it D1) closes with a Red candle. On the next day (Let us say it D2) there was not so much movement in prices and a small Bearish or Bullish candle was formed ( It can be Green colored or Red colored ). Size of the D2 candle should be small because it indicates neither bulls were very active nor bears. On the third day ( Let us say it D3 ) a bullish candle is formed which closes above the high of D2 candle. If the size of D3 candle is large then its better.

As this candlestick pattern is a reversal pattern which means there should be some previous trend to reverse and in the case of the Morning Star pattern , the previous trend should be downward. Once a trader identifies this pattern in a downtrend, they can go long (after D3 candle is closed as the probability of trend reversal is high).

What is a Perfect Pattern for Morning star

- D2 candlestick open and close should be Below close of D1 candle ( This means a gap down D2 candle )

- D3 candlestick open and close should be Above close of D2 ( This means a gap up D3 candle )

Understanding the Morning Star pattern – Trader Psychology

As this candlestick pattern appears at the low of a downtrend, the morning star pattern shows that reversal is likely to happen and indicates that bulls have started dominating the market. As more buyers enter the market and drive prices higher, this pattern has a higher probability to break the current downtrend.

Lets see what each candle indicates to a Trader

D1 candle: Red bearish candle in an ongoing downtrend

This shows the market sentiment is still bearish as sellers are pushing the prices down and they dont see a reversal yet.

D2 candle: A Doji / Small candle/ Hammer Candle ( It can be of any color but if its green then better )

This shows that traders are indecisive now . Doji shows a range bound movement or a halt in bearish market sentiment. ( This is like you apply a break to a car moving at a good speed before taking a turn ) . It gives a signal that bulls might come in the market to change the direction. A hammer candle indicates bulls dominating the session.

D3 candle: Green candle with a normal or big body

After there is indecisiveness/bullishness in the market ( Shown by D2 candle ) , D3 candle shows that bulls have started dominating the market by pushing the prices up. Now all sellers who have taken position on D1 candle ( because market sentiment were bearish at that time ) will start either selling at a loss or in the fear of incurring a loss by taking small profit. This will push prices further up.

How to spot a Good Probability Morning Star pattern on the candlestick chart

- First mark support and resistance zone on the candlestick chart

- Identify the current trend. It should be downtrend if you want to trade on this pattern

- Now find this “three candlestick pattern” where the first candle should be red , second candle should be doji/small body/hammer candle ( Called as spinning top also ) and third candle should be long green candle. D3 (3rd candle) should close above the high of D2 (2nd candle)

- Check whether this candlestick formation is at the support zone. If there is a support zone then probability of the setup increases

- Volume: If D2 candlestick has low volume and D3 candlestick has high volume , then the probability of pattern increases.

- Stop Loss: Stop loss in Morning star pattern can be kept at slightly lower level from D2 candle low which is small or a doji candle. Suppose if D3 candle is very large then you can put stop loss at D3 candle low also.

Example of Morning Star Pattern

Example 1: Bombay Dyeing on 1 D timeframe

Example 2 : Canara Bank

How to Trade Morning Star Pattern?

Now we know that the Morning star pattern is powerful when it is formed in the downtrend and probability of reversal after this candlestick pattern is high but there are few scenarios that a trader should consider:

1.If the pattern formation is not perfect

Suppose you don’t get a perfect pattern ( How a perfect pattern is formed was mentioned at the start of this article) , then should you trade or not?

You should focus more on what is happening on the chart and try to understand the price behavior’s. Like we have mentioned before in this article ( Under section psychology of traders when this pattern is formed) , first there should be a halt in the prices and then bulls should take control . This can happen if there are more than 1 spinning tops candle or if there is no gap down when spinning top candle is formed etc. These are all variations in this pattern but the psychology is the same and hence reversal can happen . The variations are more common and occur frequently in the market then perfect morning star pattern , so a trader should practice and understand the variations to trade on this pattern.

2.The location is not supporting reversal

In trading we should look for a high probability or “A category trades” where most of the things are in our favour. Suppose you are taking a trade with this patten which is not at a particular support zone then it might be possible that reversal will fail. So, it is not a high probability trade in this case and you can wait for another entry.

3.What is price action telling us after we have entered the trade

Once you have entered the trade , is it making higher highs and higher lows ( Which means uptrend has started ) ? Monitoring the market after trade will help you getting confidence in price action trading. This doesnt mean that you should panic after entering the trade, but monitoring will give you confidence.

StocksGully Tip:

Why low of Morning star is important ?

- The low of Morning star candle act as a support zone and it is a key level which should be marked by the trader for future price action at that level.

- If D3 candle close above 50% of the length of D1 candle , then its better.

Does Morning star pattern work if stock is in strong downtrend?

If the downward trend is very strong and prices has come to a support zone, do not take trade immediately after this pattern is formed. In most of the cases, there is no V shape reversal. If this candlestick pattern is formed, it will give a hint that buyers might be activated at this level. Once prices stays there for few more candles and move upwards, then it can be a good probability trade.

Key Takeaways and Points To Remember

- The morning star candlestick pattern is a three-candlestick pattern where 1st candle show bearishness with a red candle , 2nd candle show inactiveness with doji/spinning top/hammer candle and 3rd candle shows that bulls are active in market with a large body green candle closing above high of second candle.

- It is a reversal pattern which is more powerful when the current trend is downward

- As the stop loss is 2nd candle low, it gives a good risk reward ratio . If the length of 3rd red candle is large , stop loss can be kept at 3rd candle low too.

- Always calculate the risk reward before taking a trade.

- If the location of the candle is also favourable then it becomes a high probable trade

FAQ’s

What is Morning Star candlestick?

Morning Star candlestick is a three-candle reversal pattern . Once it is formed in a downtrend , then prices will either halt or reverse from the location. Low of the pattern act as a support for future price action.

Is Morning Star bullish or bearish ?

Morning Star is a bullish candlestick pattern. After this pattern is formed, there is a high probability of trend reversal as market sentiment has changed. It is indicated by bullish green candle (D3 candle)

What is the target in Morning Star pattern?

Candlestick pattern indicates trader psychology and also help in understanding price movement in future but it doesnt tell target that a trader should take . Technical analysis should be used for setting up the target but still a trader can set target at risk reward of 1 or 2. Stop loss is the low of D2 candle.

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary for educational purpose only and does not constitute investment advice. StocksGully will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.