Bearish engulfing pattern is a reversal candlestick pattern which can give a very good risk reward ratio if identified correctly. We will understand 3 things here like we have covered in Bullish engulfing pattern

- What is Bearish engulfing pattern?

- How to spot this pattern on chart and what it means?

- How to take high probability trades using this pattern?

Type of candlestick pattern: Reversal candlestick pattern

No of candlestick pattern: 2 candles pattern

What Is a Bearish Engulfing Pattern?

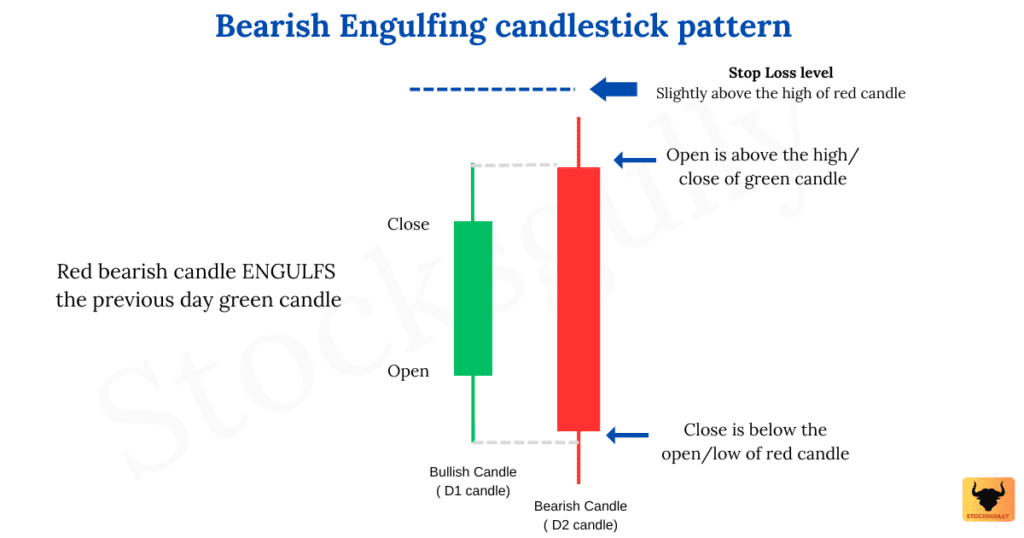

We will understand this pattern assuming we are trading in a daily timeframe. Suppose there is an uptrend going on and a day (Let us say it D1) closes with a green candle. On the next day (Let us say it D2) prices opened above the high/closing of the previous day’s green candle but closed below the low/open of the green candle. This means that the candle of day 2 (D2) will be red (As closing price is lesser than opening price) and it will engulf the previous day green candle.

As this candlestick pattern is a reversal pattern which means there should be some previous trend to reverse and in the case of a bearish engulfing pattern, the previous trend should be upward. Once a trader identifies this pattern in an uptrend, they can go short once red engulfing candle is closed as the probability of trend reversal is high.

Understanding the Bearish Engulfing Pattern – Trader Psychology

As this candlestick pattern appears at the high of an uptrend, the bearish engulfing candle shows that reversal is likely to happen and indicates that there is selling pressure at that level. As more sellers enter the market and drive prices lower, this pattern has a higher probability to break the current uptrend.

StocksGully Tip

The high of red engulfing candle act as a resistance zone and it is a key level which should be marked by the trader for future price action at that level.

How to spot a good probability Bearish engulfing pattern on the candlestick chart

- First mark support and resistance zone on the candlestick chart

- Identify the current trend. It should be uptrend if you want to trade on this pattern

- Now find this “two candlestick patterns” where first candle should be green and second candle should be red. Red candle should engulf the previous green candle with the close of red candle below the low/open of green candle and open of red candle above the high/close of green candle.

- Check whether this candlestick formation is at resistance zone.

- Stop Loss: Stop loss in bearish engulfing pattern can be kept at slightly higher from red candle high (D2 candle) which engulfs the previous green candle. (D1 candle)

Example of a Bearish Engulfing Pattern

Example 1 : DIVIS Lab on 1D time frame

Example 2 : Bank NIFTY on intraday (5 min time frame)

How to trade Bearish Engulfing Pattern?

Now we know that the bearish engulfing pattern is powerful when it is formed in the uptrend and probability of reversal after this candle is high but there are few scenarios that a trader should consider:

1.The length of red engulfing candle is very large: Suppose you are taking a trade in Bank nifty where the length of red candle (D2 candle which engulf D1 green candle) is 100 points on spot chart. Let us assume you are taking at the money (ATM) call then, it is a risk of around 50 Rs / lot and as per trader’s risk capacity he can decide to go for this trade or wait for a better entry. So always consider the risk if the engulfing candle is too large

StocksGully tip:

The downward movement is faster as compared to upward movement. This happens because traders’ emotion of fear is far greater as compared to the emotion of greed. So even if the length of red engulfing candle is large, it might be possible that prices fall faster after this candle. It also might not give entry to trader who is looking for retracement.

2.The location is not supporting reversal: In trading we should look for a high probability or “A category trades” where most of the things are in our favour. Suppose you are taking a trade with this patten which is not at a particular resistance zone then it might be possible that reversal will fail. So, it is not a high probability trade in this case and you can wait for another entry.

3.The candle formation is not perfect: This scenario will happen when D2 candle close is not below the previous green candle but may be at the same level or slightly higher. This can also be considered as the engulfing candle and it depends on the experience of the trader if he/she initiates the trade.

StocksGully Tip:

Does bearish engulfing candle work if stock is in strong uptrend?

If the upward trend is very strong and prices has come to a resistance zone, do not take trade immediately after bearish engulfing candle is formed. In most of the cases, there is no V shape reversal. If this candlestick pattern is formed, it will give a hint that sellers might be activated at this level. Once prices stays there for few more candles and move downward, then it can be a good probability trade.( Check Fig 4)

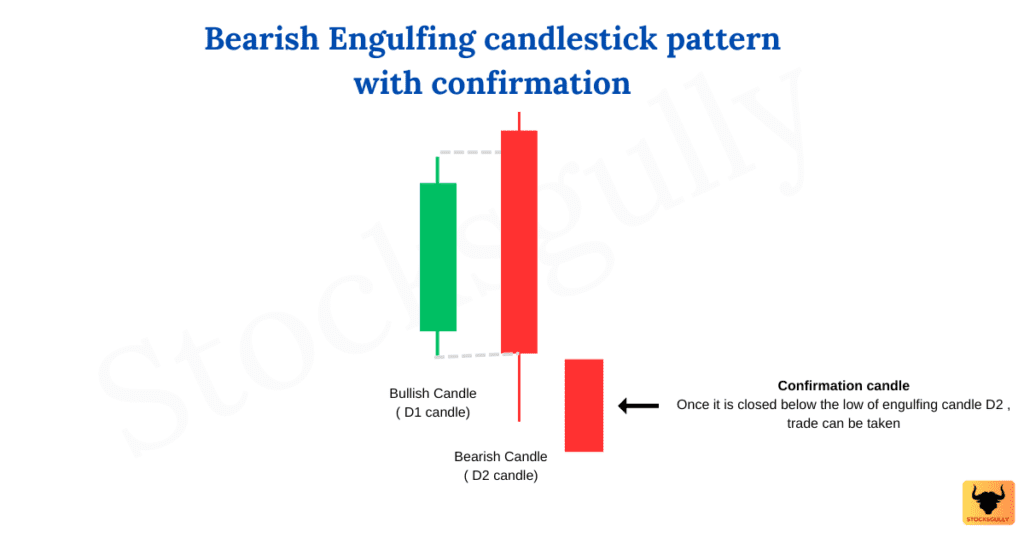

4.Waiting for confirmation candle: You can also wait for entry on the confirmation candle which means if the next candle after the red engulfing candle (The third candle which forms just after this pattern is formed) crosses below the second red candle low. This entry style depends on risk that trader can take

5.If the day 1 candle is Doji: If the candle which is formed on Day 1 is Doji (Color does not matter but if it is red then better), the probability of the reversal increases when this pattern is formed. This happens because the doji candle is an indecision candle and it means that after uptrend there is a balance between bulls and bears now. The day 2 red engulfing candle is a signal that bears have taken control now.

Key Takeaways and Points To Remember

- The Bearish engulfing pattern is a two-candle pattern where 2nd candle (red color) engulfs the previous candle (green candle)

- It is a reversal pattern which is more powerful when the current trend is upward

- As the entry is at engulfing candle with high of candle as stop loss, it gives a good risk reward ratio

- Always calculate the risk reward before taking a trade.

- If the location of the candle is also favourable then it becomes a high probable trade

FAQ’s

- When to use the bearish engulfing pattern?

This pattern has high probability when there is an uptrend (Bulls are in power) and then bears take over indicating selling pressure.

- How to find bearish engulfing pattern?

There are 3 things which you should look at:

- There is an uptrend going on.

- Suppose a particular day (D1) closes with a green candle or Doji. The next day candle (D2) is red and totally engulfs the previous day green candle indicating selling pressure.

- The pattern success rate increases if it is formed at a resistance zone

- How accurate is bearish engulfing pattern?

There is no pattern which has 100% success rate but bearish engulfing pattern is very powerful pattern. When other factors like – “pattern forming at a resistance zone “are also there, winning rate for trader will increase.

You should also backtest this candlestick pattern to understand how accurate it is basis your analysis and trading style. This pattern should develop after a long uptrend and not in sideways market for trader to trade effectively.

- What happens after a bearish pattern?

After this pattern is formed, there is a high probability of trend reversal as market sentiment has changed. It is indicated by bearish red candle

Trend reversal: – It does not always mean that price reversal will happen, it also means that prices might move sideways also from that level.

Any opinions, news, research, analyses, prices, or other information contained on this website is provided as general market commentary for educational purpose only and does not constitute investment advice. StocksGully will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.