Once you enter into stock market whether it is for investing for long term, swing trading, positional trading or if you are doing intraday trading in stock or options , one term which you will come across is “candlesticks”. But before going through this concept , let’s look at 4 different things that you need to understand before jumping into stock market:

- Risk capital: It is the capital which you will use for investing or trading

- Technical / Fundamental analysis: Understanding of technical or fundamental analysis will help you to understand the price behaviors’. Basis analysis of the price movement, you will be entering and exiting the trade.

- Risk and money management: It is how you manage the risk in trade.

- Trading psychology: A trader need to build the psychology over a period and it is the most important thing to become a successful trader. We will go step by step on this topic going forward which will help you immensely.

In this article we will understand “candlestick” which is very important to analyze the price behavior’s and in analyzing the chart. This is the starting point in technical analysis (Point no 2 above). So, let’s start

What is a Candlestick?

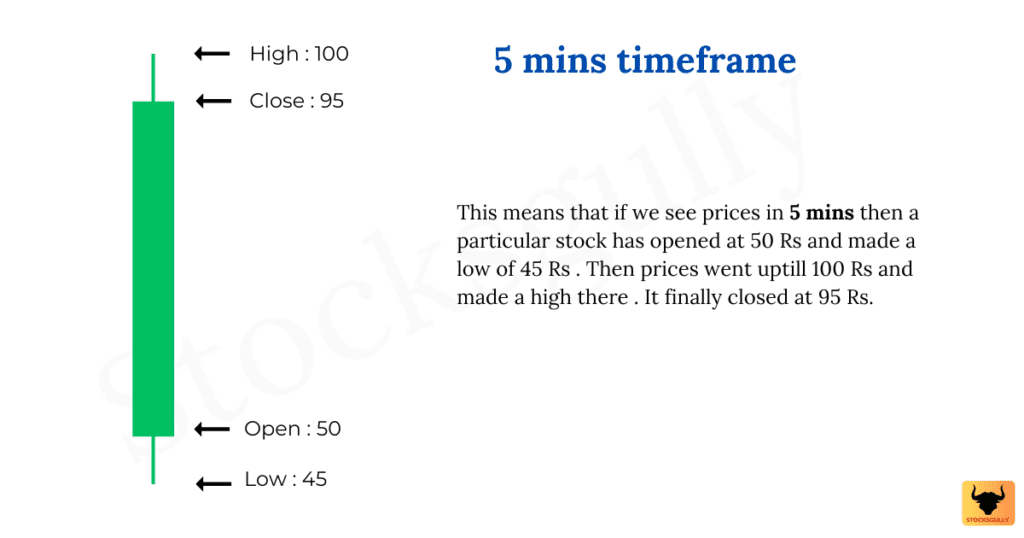

Candlesticks show the price movement in a certain period which depends on the time frame of your analysis. Time frame can be 5mins, 10 mins, 1 hour, 1 day, 1 week or 1 month also. A candlestick is formed using the trading day’s time frame open, high, low, and close values. All these important values (Open, high , close and low ) is represented visually so that a trader know all these things in a single bar.

Example: If the time frame of you analysis is 5min then a single candle will show open, close, high and low values of 5 mins for the scrip (Stock, index , etc. ) you are analyzing.

What are different parts in a candlestick ?

Body:

A box in candlestick is called body whose length is the difference between the open price and close price.

Shadows:

Thin vertical lines that are called the shadows or wicks are above and below the body, representing the high and low prices reached during the timeframe of your analysis.

Bullish candlestick:

A bullish candlestick is formed when closing price is more than the opening price. This means that buyers were dominant on sellers to push the prices up. It is usually shown with a green candle on charts provided by brokers or charting software’s.

Example: Suppose price opened at 100Rs and closed at 120Rs. As close price is greater than open price so when it is represented by a candlestick, it will be shown with green color and it will be a bullish candle.

Bearish candlestick:

A bearish candlestick is formed when closing price is less than the opening price. This means that sellers were dominant on buyers to push the prices down. It is usually shown with a red candle on charts provided by brokers or charting software’s.

Example: Suppose price opened at 100Rs and closed at 80Rs. As close price is less than open price so when it is represented by a candlestick, it will be shown with red color and it will be a bearish candle.

Note : Open and close are opposite in bullish and bearish candlestick as shown in the image

There are lot many variations, types of candles and patterns which are formed with candlesticks and we will understand that as we go forward. Though single candlesticks convey valuable information about the changes in a market’s supply (Sellers) and demand (buyers) balance and can give powerful trading signal, but a group of two or more candles in a certain sequence are more appropriate for trading setup as they make a pattern. One you start identifying a pattern, it will give you an edge in trading and you can understand price action better.

Use of Candlesticks

One of the most basic objective to analyze any particular chart is to – “Enter the trade and exit it profitably” . If we have to achieve this objective , then we should know :

- Levels when prices will move up ( Bulls are in control ) or the levels when prices will move down ( Bears are in control ).

- Change in market sentiment from bearish to bullish or bullish to bearish

So a candlesticks give valuable information about the psychology and underlying price dynamics of the market . It helps you in understanding whether market sentiments are bullish or bearish by analyzing candlestick patterns. You should always pay attention to bullish and bearish candlesticks patterns formed at a significant support and resistance levels ( We will discuss support and resistance in detail later ). The analysis becomes very important and conviction can come while trading if you also analyze the current trend also in a larger time frame.

Experienced technical traders prefer to rely more on patterns of two or more successive candlesticks rather than single candlesticks in assessing whether price will reverse or continue in the current trend. Successful trading also requires waiting for the confirmation of a pattern before taking any trade, even in cases in which the patterns have a high success ratio. This patience is required because sometimes a pattern can emerge as a result of a very short trend or a horizontal move and it may never be confirmed. In such cases of non-confirmation, it is better to wait in order to avoid a losing trade . You can enter the trade later also when confirmation is there

Note : When we study individual patterns , we will discuss what is “confirmation of trade means”. Basically it gives more conviction to a trader while entering the trade.

Types of Candlesticks

We will understand different candlestick types ( Doji , hammer etc. ) and patterns ( Bullish engulfing , Three white soldiers etc.) in detail as we go forward but any candlestick is classified into different types basis 3 things:

- Length of the body

- Whether there is a shadow or not in the candle

- If there is a shadow than what is the length of the shadow

Example : A Doji has very small body and both side wicks/shadows but at the same time, hammer has small body but very big lower shadow/wick. We will understand all this in detail later

Candlestick patterns

The patterns which are a group of candlesticks interpreted together are formed by two, three, four or five successive candlesticks. Some patterns you will find frequently on charts and some patterns are formed rarely.

Most common: 1-day and 2-day patterns

Pattern which are very rare: 4/5-day pattern.

Understanding patterns might seem complex to you at start but that’s what our aim at StocksGully to make things easier for you and we will try our best. You will also find it easier when you become familiar with few candlestick patterns. In case of any queries, you can comment and we will try to answer it as soon as possible.

Key takeaways and points to remember:

- A candlestick is formed using the trading day’s timeframe open, high, low, and close values.

- It has body and shadow/wick.

- When closing price is greater than opening price, it is called bullish candlestick and usually shown in green color. When closing price is less than opening price, it is called bearish candlestick and usually shown in red color.

- Single candlesticks give valuable information about the psychology and underlying price dynamics of the market

- A pattern is formed when a group of candlesticks is analyzed in a particular sequence with some criteria. It can be 2 candlesticks, 3 candlesticks or 4/5 candlesticks patterns

FAQ’s

-

What is candlestick in trading?

Candlesticks show the price movement in a certain period which depends on the timeframe of your analysis. It can be 5mins, 10 mins, 1 hour, 1 day, 1 week or 1 month also. A candlestick is formed using the trading day’s timeframe open, high, low, and close values.

-

What are candlesticks used for?

Candlesticks give valuable information about the psychology and underlying price dynamics of the market. It helps you in understanding whether market sentiments are bullish or bearish by analyzing candlestick patterns.

-

What are the 4 parts of a candlestick?

A candlestick is formed using the trading days’ time frame open, high, low, and close values. All these important values (Open, high, close, and low) are represented visually so that a trader know all these things in a single bar.

- Open : It is the first trade price for the candlestick period. This also marks one end of the body of the candle.

- High : It is the highest trade price for the candlestick period and is also displayed as a shadow or a wick.

- Low : It is the lowest trade price for the candlestick period and also displayed as a wick or shadow.

- Close : It is the last trade price for the candlestick period and marks the other end of the body.

I hope this article has helped you in understanding the basics of candlesticks.

Happy Trading and Investing !