There are many time frames that a trader can choose from basis his/her trading style. For beginner traders there can be many questions in mind like “What is the best time frame for intraday trading?” or “what is the best time frame for swing trading?” and much more, which we will try to understand in this article. It will help you to choose best time frame for trading basis your own trading style.

Suppose there are two friends – Mr X and Mr Y. Mr X is a day trader and want to analyze the chart every few minutes as he will be taking his trading decision basis the price movement happening every minute. At the same time Mr Y is a positional trader and he might not analyze the chart daily because he has invested for a longer duration (Week, Month, Year etc.). So, while both will analyze the same chart but the time frame for analysis will be different.

So first let us understand what are the time frames in trading?

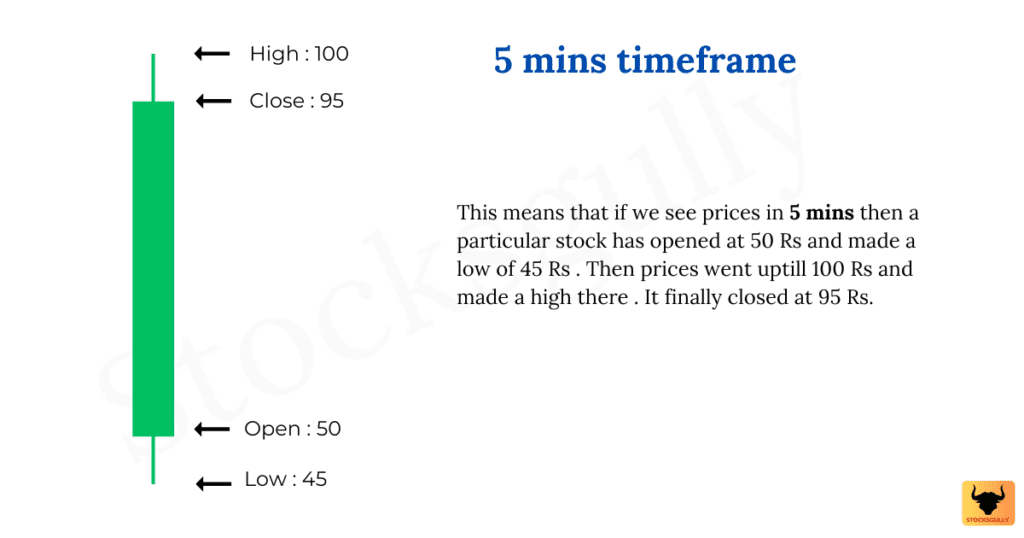

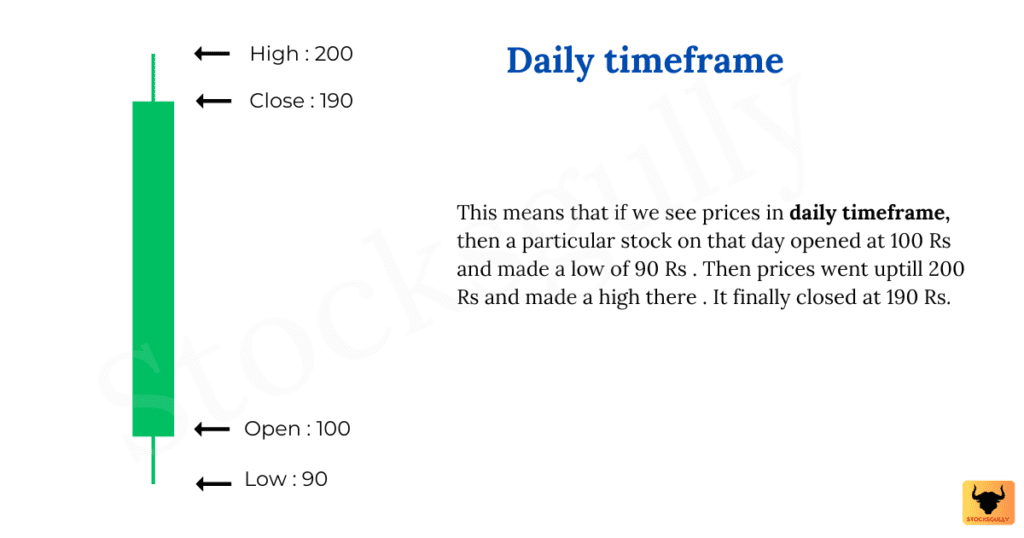

A time frame is a period where price movements happens and it is communicated to a trader with candles (Assuming we are using candlestick chart). This could be in minutes, hours, weekly, monthly etc.

Example:

If you are using 5 mins time frame on charts then every candle will show you price movement of 5 mins (High, low, close, and open values). So, you will have 12 candles in an hour (60 mins / 5 mins = 12)

But if you are using daily time frame then each candle will show you daily price movement as one candle. So, a week will have 5 candles as there are only 5 trading days in a week. High, low, close, and open values are for that day when candle is formed

How to choose best time frame for trading?

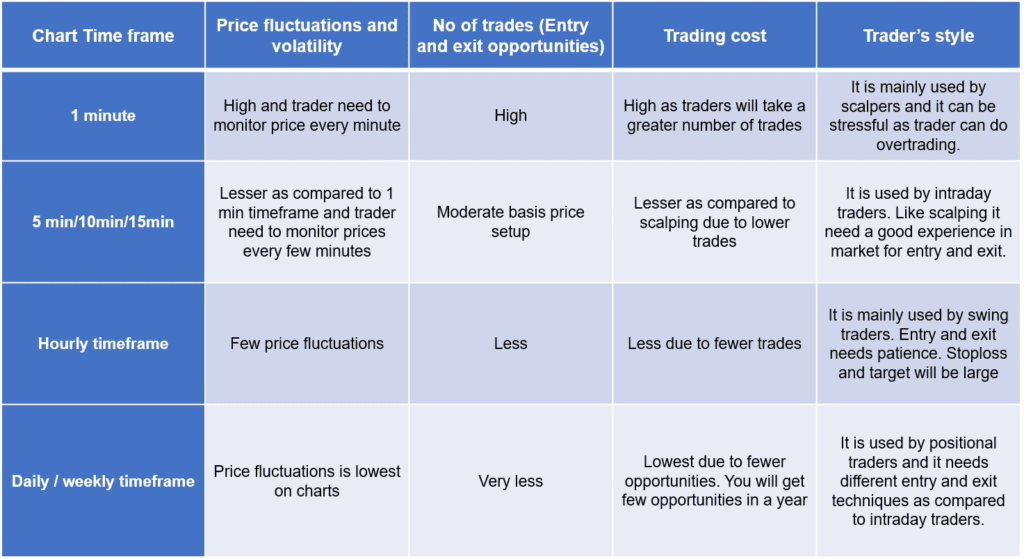

There is no best or worst timeframe in trading and it depends on your style of trading. Scalpers use shorter time frames and positional traders uses longer time frame. We will understand this with a help of few scenarios which will help you in choosing a time frame.

Scenario 1:

Mr X is an intraday trader: He will trade on smaller time frame (5 mins, 15 mins etc) because he will take entry and exit in a day. So, it is important for him to monitor prices in smaller timeframe

Scenario 2:

Mr Y is positional or swing trader: He will trade on larger time frame (1 day, 1 hr or may be 1 week) because he will hold the stock for larger period (It can be months or year). There is no need to monitor prices every few mins and he might check it at the end of the day.

Scenario 3:

Suppose Mr Z is a part time trader and he has a full-time job too: Now Mr Z might not get time in his office to check the prices again and again so he will trade either long term or if he wants to enter and exit on same day then he might use 15 mins, 30 mins or even 1 hr. timeframe also.

So, this is how a trader based on his trading style will choose the timeframe best suited to him. If you still want to understand basis your style, check this chart below

Best time frames for Scalping:

This type of traders enters with a small stop loss and small targets. They usually do not hold the positions longer and exit in few mins. Scalpers can use 1 min to 5 mins timeframe as entry and exit is very fast.

Best time frames for intraday trading:

A day trader can choose a time frame of 5min to 15mins to identify entry and exit basis the setup and strategy. These traders analyse prices every few minutes.

Best time frames for Swing trading:

A swing trader can choose a time frame in hours like 2 hour or 4 hour or daily time frame to take his positions. These types of traders can hold the position for few days to few weeks’ basis price movement

Best time frames for Positional trading:

A swing trader can choose daily timeframe to enter and exit trades. These types of traders can hold the position for few days / weeks or month basis the current trend and they focus on price movements which happens on long term. They do not monitor the prices every few minutes.

Best trading timeframe for beginners:

As a beginner trader, it is better to start analyzing the chart on daily timeframe. Larger time frame has lesser noise (Which means price fluctuations due to volatility which can confuse a beginner trader) and better price movements which can help you to analyze the market trend.

I hope this article has helped you in choosing time frame basis your trading style .

Happy Trading and Investing !