One of the most common question for a new trader is – “Discount Broker Vs Full-Service Broker”. As per reports the number of demat accounts opened in India (Financial Year 2023) is around 2.5 Cr and now total demat accounts is around 11.5 Cr as compared to around 9 Cr in Financial year 2022. This means 20 lacs demat accounts are opened every month. With more people using smartphones and with increased internet penetration, it has become easier to trade in stock markets. The first step to start an investing or trading journey is to open trading and demat accounts for which you need a broker. There are two options which you can choose from – Discount broker or full-service broker.

The type of broker you want to use depends on your need and how you want to approach investing or trading in stock markets.

Let us see an example with the help of two friends (Arun and Rohit) who want to start their trading journey.

Arun:

- He has started learning from different sources available like online videos, books on trading and investing etc.

- Arun is looking for a broker which gives him platform accessible on web/mobile to start trading/investing with easy-to-understand portal so that he can buy and sell

- He is currently not looking for any other additional services from brokers as he wanted to learn all the aspects of trading by himself.

- His long-term plan is to take trading as a career and hence he wants to invest his time from scratch to learn markets.

Rohit:

- Rohit wanted to invest or trade in stocks but not getting time to learn about stock markets.

- While there are different websites and sources which provide stocks advice or sector knowledge like ET markets etc but he also wants broker to provide him market analysis and investment advice on a regular basis.

- He is also looking for a platform which he can also use on mobile / desktop to buy and sell stocks

If we go by the need, Arun is likely to open an account with a Discount broker and Rohit with a full-service broker.

But where will the difference come from?

It is in the brokerage and other cost that they pay. As Arun is using a discount broker , he will pay limited fees such as transaction and AMC charges, which are kept to a minimum. As he is learning the stock market on his own and applying knowledge or expertise to trade in markets, he will also save on paying additional fees which are usually charged by full-service brokers.

Does higher fees mean investors/traders don’t go with full-service brokers?

It depends on the service that you want and willingness to pay the service fees. Full-service brokers offer guidance to their clients along with stocks recommendations, allocation amount etc. Full-service brokerage firms also offer portfolio management services.

You might also find physical branches (like banks) for full-service brokers where you can go and discuss the portfolio and any other queries with their executives. Discount brokers are only online as of now.

Name of few discount brokers in India:

- Zerodha

- Groww

- Dhan

Name of some full-service brokers in India:

- HDFC Securities

- ICICI securities

Note: This list does not contain all the brokers but few names were mentioned to explain the difference.

Choosing Between Discount Broker Vs Full-service Broker

Whether an investor opts for a discount broker or a full-service broker depends on their investing knowledge, market experience, time which he/she can invest to trade daily etc. Since commissions are high for full-service brokers, it will take out a good chunk of money from investment and trading returns. This is one of the main reasons that young traders now a days prefer discount brokers. Once a trader is in a learning phase they don’t want to pay much large cost as commissions.

If a trader is actively involved in markets and taking multiple trades, he will see a huge difference in terms of cost charged by full-service brokers and discount brokers. As discount brokers charges a flat fee per trade, the trading cost is far lesser for active traders in the market.

You can also check brokerage calculator provided by brokers to check the brokerage charges. It will give you a good idea on the cost basis quantity that you are planning to trade.

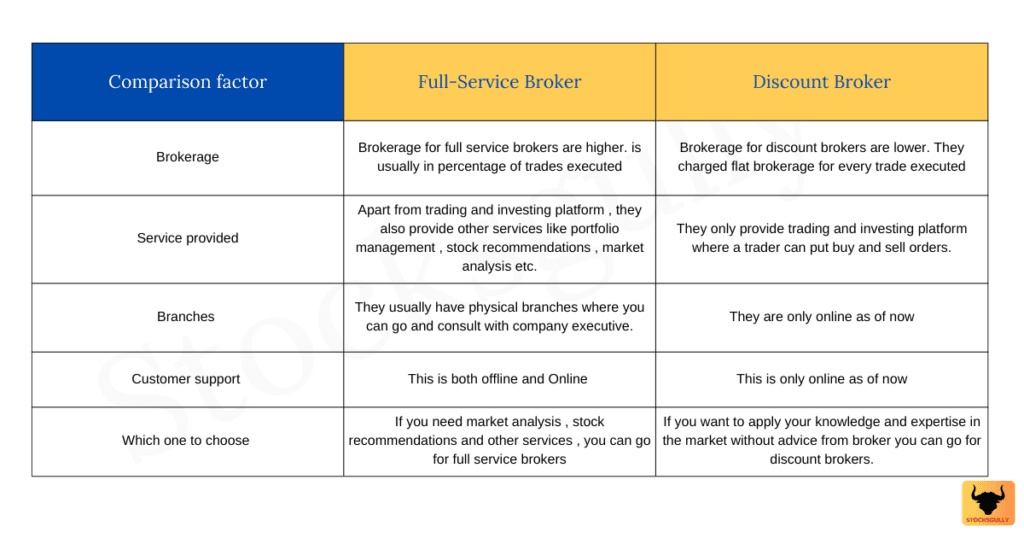

Discount Broker Vs Full-service Broker : COMPARISON CHART

Key points

- Discount brokers do not offer additional services like portfolio management or stock advice etc. Full-service brokers offer lot many services as compared to discount brokers

- A trader must pay higher fees to full-service brokers as compared to discount brokers. This is because of additional services provided by full-service brokers

- Choose between discount and full-service broker as per your need. If you need investment advice and market analysis from your broker then go with full service brokers otherwise you can choose discount broker.

Also read:

Frequently asked questions

What are the advantages of using a discount broker?

The main advantage of using discount broker is the limited brokerage fees per trade. This is very helpful for beginner and active traders as the cost of trading is reduced with less brokerage.

Which type of broker is best for first time investor?

This depend on the need of first time investor or trader. If you don’t want to actively learn stock markets but still want to invest using investment advice / market analysis or stock recommendations then you can go for full-service brokers.